Exploration

Crypto Updates

Economic Scene

The Countdown Begins – Major Banks on Wall Street Forecast Rate Cuts Before FED’s Decision on Wednesday

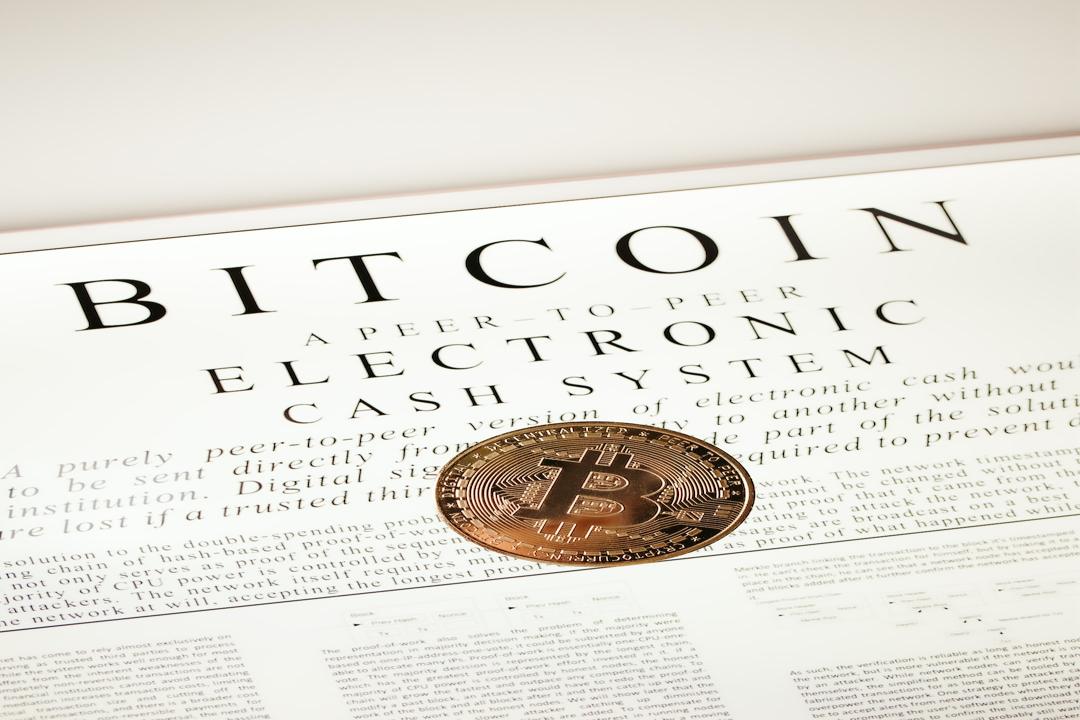

The much-anticipated FED interest rate decision on Wednesday is looming, and big banks on Wall Street have shared their forecasts, impacting not only traditional markets but also the world of cryptocurrencies.

By:

Mete Demiralp

10.06.2024 – 19:22

Update:

6 seconds ago

0

In the wake of robust employment figures last week and in anticipation of the FED’s upcoming decision to maintain current interest rates, leading banks on Wall Street have unveiled their projections for the first interest rate cuts of 2024.

Predictions on the timing and magnitude of these rate cuts vary among the banks, with some expecting cuts as early as September, while others foresee delays until December or even into 2025. Anticipated reductions range from 25 basis points (BPS) to 100 BPS.

Related News

Wintermute CEO: “Ethereum’s Fate Rests on This Factor, Not Solana”

Here are the banks’ forecasts for interest rate cuts based on their internal data:

Bank of America, BNpp, and Deutsche Bank anticipate a 25 BPS rate cut in December as the first move.

Barclays, Citigroup, Evercore ISI, Goldman Sachs, HSBC, Kalshi, Morgan Stanley, Nomura, Oxford Economics, TD Securities, UBS, and Wells Fargo predict the first reduction to take place in September, with discounts ranging from 25 BPS to 75 BPS.

JP Morgan and LH Meyer foresee the initial cuts in November and December, each with a 25 BPS reduction.

MUFG expects an aggressive 100 basis point rate cut as early as July.

RBC also predicts a 25 BPS reduction in December.

Jefferies, Mizuho, and Societe Generale do not anticipate any interest rate cuts until 2025.

*This is not financial advice.

To trade over 300 cryptocurrencies, sign up with Binance exchange using this link for a 20% COMMISSION DISCOUNT!

For exclusive news, analysis, and on-chain data, follow our

Telegram

and

Twitter

accounts now!

Notify me of follow-up comments from this article

Notify

When a response is made to my comment

Label

Name:

Mail

Δ

Label

Name:

Mail

Δ

0

Comments

Inline Feedbacks

View all comments