Exploration

Cryptocurrency Tidings

News

The Ongoing Clash of Titans in the Bitcoin Arena! Who Bears the Brunt – Longs or Shorts in the Near Term?

Author:

Elif Azra Güven

05.07.2024 – 07:57

Update:

3 seconds ago

0

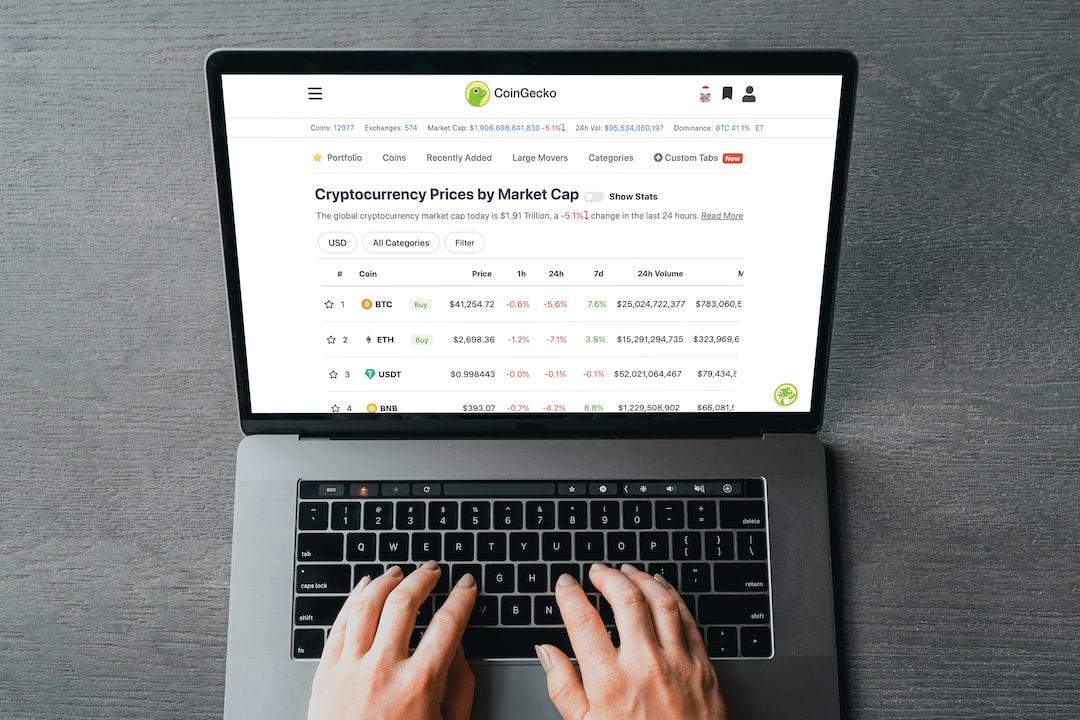

Bitcoin faced substantial downside pressure due to the BTC transfers initiated by the insolvent crypto exchange Mt. Gox as part of the reimbursement process it kick-started.

Related Developments

Unveiling the Rationale Behind Bitcoin’s Plummet! Official Declaration from Mt. Gox!

In the backdrop of this development, as BTC dipped below $54,000, the publication of the US Non-Farm Employment data later today is poised to wield an influence on the market dynamics.

Traders eyeing short-term momentum swings in Bitcoin are plunging into short positions, anticipating a prolonged downtrend, while others are assuming long stances.

Nonetheless, Bitcoin’s characteristic volatile nature could trigger abrupt and drastic price fluctuations, leading to the liquidation of investors on both sides.

Per data from Coinglass, a surge to $56,000 in Bitcoin could result in the liquidation of short positions totaling $791 million.

Conversely, a drop to $50,000 could trigger the liquidation of long positions valued at $489 million.

Bitcoin’s Trajectory: Tied to Mt. Gox’s Fate!

As the tug-of-war between the bullish and bearish factions in the Bitcoin domain persists, Rachel Lin, CEO and co-founder of the decentralized platform SynFutures, remarked to Decrypt that the selling pressure on Bitcoin is unlikely to abate in the forthcoming days.

Lin indicated that Mt. Gox hinted at a scenario where most of its users might offload their Bitcoin holdings, envisaging a probable rebound in Bitcoin prices if the sell-off falls short of expectations.

“Conversely, a sustained downtrend resulting from substantial sell-offs could usher in the $50,000 threshold,” Lin added.

*Note: This does not constitute investment advice.

To partake in the cryptocurrency market comprising over 300 assets, you can sign up on Binance exchange with a 20% COMMISSION DISCOUNT using this referral link!

For exclusive news, analytics, and on-chain insights, follow our

Telegram

and

Twitter

channels now!

Receive Notifications from Comments Here

Report

Notify me when new replies are added to my comment.

Label

Name:

Email

Δ

Label

Name:

Email

Δ

0

Comments

Inline Feedbacks

View all comments